Changes to Contribution Provisions

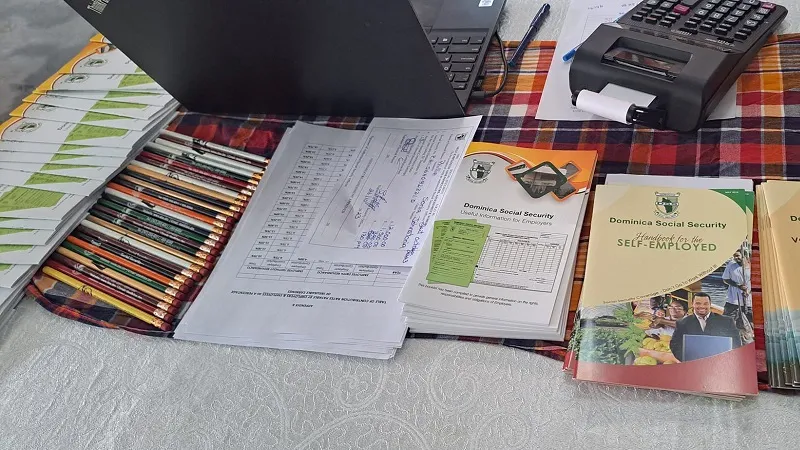

Members of the public are hereby reminded that, pursuant to the provisions of Social Security (Amendment) Regulations, S.R.O.’s 4, 7 and 8 of 2012, the following changes are to take effect as of 1st January 2024:

Increase in the Contribution Rate:

The contribution rate payable by Employers, on behalf of their Employees, Self-employed persons and Voluntary Contributors shall increase by ¼ % (0.25%) vis:

| Category of Contributor | Old Rate (Applicable during 2023) |

New Rate (Applicable during 2024) |

| Employers re. EE’s with Redundancy | 7.50% | 7.75% |

| Employers re. EE’s w/out Redundancy | 7.25% | 7.50% |

| Self-employed Persons | 13.00% | 13.25% |

| Voluntary Contributors | 11.65% | 11.90% |

Further clarification on these changes can be obtained from the office of the Dominica Social Security or on the DSS Website: www.dss.dm.

Is Western Union in Roseau Dominica open tomorrow, Tuesday, Carnival day ?

It’s closed on Public Holidays. Unless the company has a specific notice for an opening-hours exception, it will operate under the regular opening and closing times.